Charitable Trusts

These legal entities benefit society by managing assets and distributing funds for specific charitable purposes.

Research topics

What are Charitable Trusts?

Charitable trusts are a remarkable financial vehicle that allows individuals to support nonprofit organizations while also enjoying considerable tax benefits. Essentially, a charitable trust is designed to provide a specified charity with either income or principal from the trust assets. This mechanism of giving not only fosters philanthropy but also serves as a strategic tool for estate planning.

Why Choose a Charitable Trust?

One of the major attractions of charitable trusts is their potential to reduce tax burdens. By donating assets to a charitable trust, individuals can significantly lower their taxable estate. This means more of your wealth can go toward the causes you care most about, and less toward taxes. It’s a win-win situation: you can contribute to your favorite nonprofit organizations and enjoy great tax deductions for your charitable contributions.

Types of Charitable Trusts

There are two primary types of charitable trusts—Charitable Remainder Trusts (CRT) and Charitable Lead Trusts (CLT). In a CRT, a donor can receive income for a designated period of time, after which the remaining assets are transferred to the charity. This allows for ongoing financial support while securing asset protection amidst estate taxes. On the other hand, a CLT provides funds to the charity first, with assets reverting to the donor or their beneficiaries later.

Integrating Charitable Trusts with Estate Planning

Charitable trusts are a sophisticated element of legacy planning. By carefully crafting the terms of a charitable trust, you can ensure that your values resonate even after you’re gone. Imagine leaving behind a legacy that supports educational initiatives, healthcare facilities, or environmental projects! Integrating these trusts into your estate plan not only provides wealth management but also engrains a philanthropic spirit in your descendants.

The Power of Endowment Funds

When we talk about charitable trusts, we can’t ignore endowment funds. These funds allow charitable organizations to maintain a perpetual income stream, which can be leveraged for long-term activities and sustainability. By setting up endowed trusts, donors can stipulate how and when the funds are used, ensuring that their contributions are utilized effectively for years to come.

Grantmaking and Donor Advised Funds

Another compelling aspect of charitable trusts is their role in grantmaking. Through mechanisms like donor advised funds, donors can actively participate in the philanthropic decision-making process. These funds allow you to recommend how grants should be distributed, giving you a sense of involvement in how your contributions impact the community.

The Tax Benefits of Charitable Trusts

Beyond the emotional rewards of giving, charitable trusts come with enticing tax benefits. Contributions made to these trusts often qualify for impressive tax deductions. This can lower your taxable income and allow for potential tax savings, making it a financially savvy choice as well.

Asset Protection Through Charitable Trusts

For those concerned about creditors or the potential validity of a claim, setting up a charitable trust can be a useful strategy for asset protection. By placing assets into a charitable trust, you are not only managing your wealth effectively but also safeguarding it against future uncertainties. This can be particularly beneficial as part of long-term wealth management strategies.

Inspiring Others: Your Philanthropic Journey

The act of setting up a charitable trust is more than just a financial decision; it’s part of your journey of giving back. As more people become aware of the significant impact and the tax benefits associated with these trusts, philanthropy can reach new heights. By sharing your story and walking others through the process, you inspire more individuals to look into their charitable options.

How to Set Up a Charitable Trust

Setting up a charitable trust can be a straightforward process if approached correctly. Start by deciding on the organization or cause that resonates with your values. Seek professional advice to ensure that you’re complying with all relevant laws, and formalize your intention in writing. Experts such as those found at Prince Trusts can provide guidance on establishing these trusts effectively.

Are Charitable Trusts Right for You?

The answer depends largely on your unique situation. Charitable trusts are potent tools for those looking to achieve specific financial, philanthropic, or estate planning goals. If you're a philanthropist at heart and eager to leave a lasting impact while enjoying considerable tax deductions, a charitable trust could be just what you are looking for.

In conclusion, charitable trusts represent a fantastic intersection of philanthropy, long-term financial planning, and strategic asset management. If you're considering joining the ranks of those leaving a meaningful legacy, consult with a financial advisor to explore the many possibilities that charitable trusts offer.

Posts Relacionados

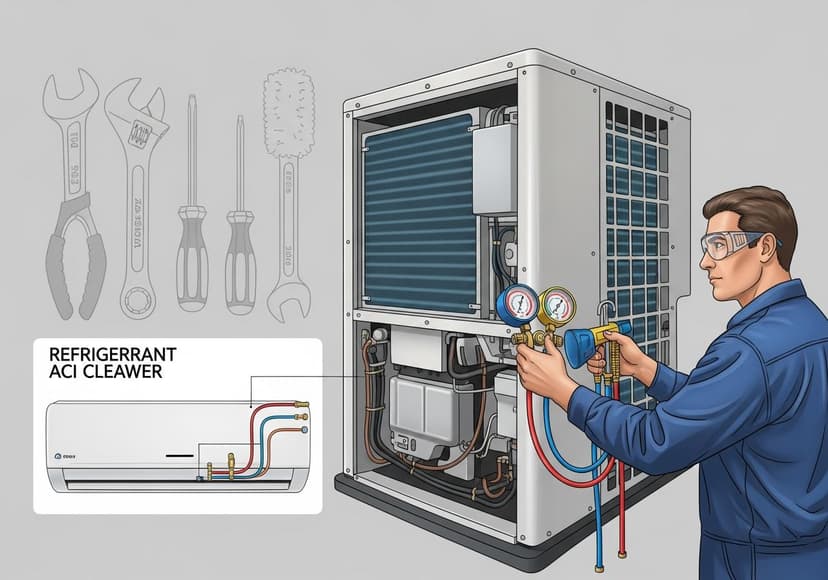

Ac Repair How To Check Your Ac Refrigerant Levels

Find reputable contractors for home energy efficiency upgrades on the official list to improve your comfort.

Adult Learning Programs For Seniors

These programs offer seniors opportunities to enhance skills, explore interests, and socialize, promoting lifelong learning and well-being.

Benefits Of Lifelong Education

Continuous learning enhances skills, boosts career prospects, and promotes personal growth and fulfillment throughout life.