Retirement Stress

Financial worries and health concerns cause anxiety. Planning and support can reduce the worry in later life.

Research topics

Welcome to your hopeful journey towards retirement! As you approach this new chapter in life, you might find the notion of retirement stress creeping in. The idea of leaving the workforce can trigger a whirlwind of emotions, primarily concerning financial stability and planning. So let's dive deep into understanding Retirement Stress and how you can combat it with proactive Financial Planning.

Understanding Retirement Stress

Retirement Stress is quite prevalent as individuals transition from their careers to a more relaxed lifestyle. The anxiety often stems from uncertainties like Healthcare Costs, inflation rates, and unpredictable Market Volatility. It’s important to acknowledge these feelings rather than ignore them. Recognizing the common causes of stress can empower you to tackle them head-on.

Several factors contribute to retirement stress. Firstly, Healthcare Costs can be a major source of concern. With medical expenses continuously rising, ensuring that you're adequately covered is crucial. Additionally, as we age, health tends to decline, increasing the need for long-term care, which adds another level of financial planning.

Another factor is Inflation. The cost of living is not going to sit still while you are happily retired; it moves, and it tends to rise, making it essential to consider this in your Investment Strategies. Deep dives into your spending habits and how to sustain them in retirement are vital.

The Importance of Financial Planning

So, how do you tackle Retirement Stress? It all begins with robust Financial Planning. Start by crafting a comprehensive budget that includes every possible expense, from Housing Costs to Long-term Care. This budget should also factor in potential debt management to alleviate any financial burdens you carry into retirement. Financial security becomes a top priority when planning how to sustain your lifestyle down the road.

Your first step is to create a budget that accurately reflects your anticipated expenses. This budget should take into account Healthcare Costs, Housing Costs, and anything related to your quality of life. Keep in mind that the last thing you want is to find yourself financially strapped because you didn't plan ahead. Look for ways to streamline your costs, especially concerning Social Security and Pension Plans. Every dollar saved counts!

As you gear up for retirement, you might wonder about Healthcare Costs. Understanding Medicare and supplemental healthcare options is a non-negotiable step in your financial planning process. Don’t forget to look into potential out-of-pocket expenses that can arise to enjoy a stress-free retirement. With rising healthcare costs, having a strategic plan in place will vastly decrease your stress.

Investment Strategies for a Stable Future

Now that your basic financial landscape is clearer let's tackle an aggressive yet wise approach to Investment Strategies. One secret to alleviating retirement stress is making informed investment choices early on. You've worked hard for your money; now it's time for your money to work hard for you.

Your typical income sources during retirement will likely come from Social Security, Pension Plans, and personal savings. It’s essential to evaluate how each of these factors into your financial plan. It’s also crucial to understand how inflation will impact your purchasing power in the years to come. Don’t hesitate to consult with a financial adviser when assessing how to strategize your investments effectively and shield yourself from Market Volatility.

In many cases, people overlook planning for Long-term Care costs. This can be a real killer of retirement dreams if not considered wisely. Whether it’s in-home assistance or nursing homes, these expenses can accumulate quickly. Make sure to consult with financial planners who specialize in aging services to set your plan for potential future care standards.

Avoiding Debt Before Retirement

Debt management is equally as vital. Carrying a significant debt load into retirement can amplify Retirement Stress. There’s nothing quite like trying to enjoy a beach vacation while worrying about the looming cloud of debt. Before you retire, make a concerted effort to pay down debts, guiding your resources primarily towards eliminating high-interest loans and credit cards.

Once you’ve managed your debts, the next step is Estate Planning. Yes, we’re talking wills and trusts! Taking the time now to set your wishes in place will help ease any anxiety regarding what happens with your assets after you’re gone. No one wants to think about this, but it’s an essential component of reducing future family stress and securing financial stability for your loved ones.

Finding Balance

As you navigate your financial future, maintaining balance becomes paramount. The stress from financial obligations can seep into our everyday lives, affecting everything from relationships to our overall mental well-being. This is why crafting a solid Financial Planning strategy is necessary to lessen your load.

Additionally, as reported in this article from Johns Hopkins Medicine, managing stress is important at any age. Engage in wellness activities, like yoga or meditation, to enrich your mental resilience alongside your financial planning.

In conclusion, while Retirement Stress can feel overwhelming, it doesn’t have to dictate your future. By investing time into comprehensive Financial Planning, understanding Healthcare Costs, and managing Debt, you're not just adding years to your life; you're adding life to your years. Your retirement should be a time to relish the fruits of your labor, not to stress about financial pitfalls.

Remember, every step taken today towards planning for retirement also prepares your loved ones for tomorrow. So, don't leave anything to chance. Embrace the idea of Estate Planning and enjoy peace of mind as you approach this exciting milestone. To read further on how a stress-free approach to retirement can rejuvenate your life, check out this insightful article on Business Insider.

With the right preparation and mindset, you can turn Retirement Stress into Retirement Joy!

Posts Relacionados

Adult Aligners Seniors

For seniors, these aligners offer discreet teeth straightening, improving oral health and enhancing smiles effectively.

Affordable General Dentistry Guide

Access affordable dental care through general dentistry; prioritize oral health.

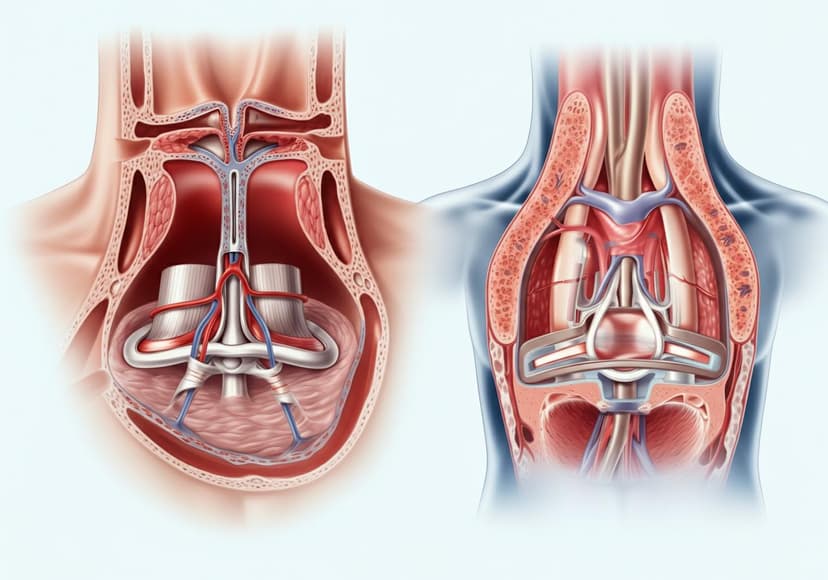

Aortic Valve Replacement For Seniors

Surgical intervention improves quality of life and longevity for elderly patients with aortic stenosis.